Bitcoin is often compared to gold, earning it the nickname, "digital gold". In our previous post, Is Bitcoin digital gold? Why Bitcoin is said to be more like gold than currency, we compared and contrasted Bitcoin and gold. Today, we’re having a look at how their prices compare.

Today, Mr. Saito from Cryptact Ltd. in Japan is here to explain the changes and price fluctuations of Bitcoin and gold.

Hello everyone! This is Gaku Saito from Cryptact Ltd. in Japan. It was in 2012 that I started seriously looking into Bitcoin.

This was during the Euro crisis and the Greek crisis, when we were concerned about Greece dropping the euro and if the drachma could recover. There was a trend of people wanting to have Bitcoin instead of drachma. When I saw “The people of Greece and Cyprus are buying Bitcoin”, I decided to look into it.

That wasn’t enough to get me to jump on the bandwagon, but I think that a lot has changed in the environment surrounding Bitcoin over the last 8 years.

Back then, we didn’t hear about Bitcoin being compared to gold. It was just about Bitcoin being used for asset transfer due to being better than drachma. I didn’t think that much about it.

Since then, I think Bitcoin has evolved in all aspects, including price, liquidity, volatility, market participants, and discussion of its potential as a digital currency.

I would like to consider how perspectives on it as an asset class have changed. Specifically, I looked for correlations in the prices and volatility of Bitcoin and gold.

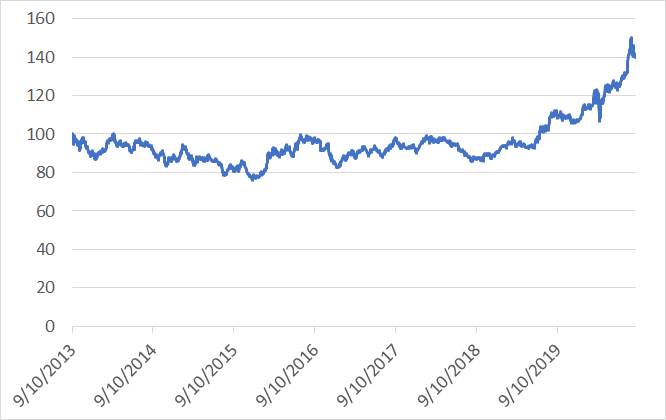

Figure 1 displays Bitcoin prices over a 7-year period, giving a general sense of price movement. The price (at the time of this writing) is just around 10,000 EUR, making it nearly 80 times what it was 7 years ago. It sounds simple enough, but it is a massive increase. At its peak 3 years ago, it was 160 times that price.

The prices for gold in the same period are displayed in Figure 2. The price did not fluctuate much for 5 years, but it rose about 30% in the last 2 years. As you can see, it has a very different movement from Bitcoin.

Bitcoin and gold are compared a lot. Bitcoin is often called digital gold.

Unlike central banks that expand their balance sheets after each financial crisis or fiat currencies with no limit to how much can be issued, Bitcoin and gold effectively have an upper limit to the amount that can be issued. Thus, the value does not deteriorate, but rather stay preserved.

This kind of story comes up any time Bitcoin or gold suddenly goes up. Recent drops in the stock market were often linked to the Bitcoin market, causing its value to lose some of its stability. So, I looked for any correlation in the price fluctuations of Bitcoin and gold.

Correlations in price fluctuations of Bitcoin and gold

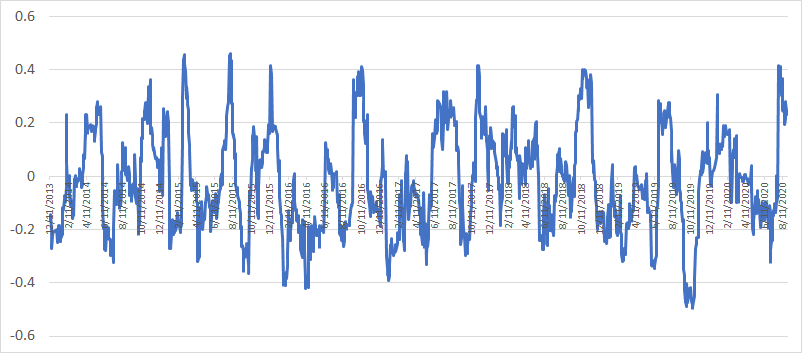

Figure 3 below shows the correlation coefficient for the price fluctuations of Bitcoin and gold over the past 30 days at the time of this writing.

A positive correlation would be 1 (move together) and a negative correlation would be -1 (move opposite of each other). Generally, anything between -0.2 and 0.2 means no correlation.

According to the graph, most of the last seven years shows no correlation. 0.2 to 0.4 shows some correlation, but if we assume that the correlation increases over the last few years are due to the significant changes in the price of gold, we can say there is no correlation.

Based on this data, we can conclude that there is not much correlation in the prices of Bitcoin and gold.

These kinds of analyses are kind of arbitrary. We could make a correlation or increase in correlation by manipulating the data by selecting a different time frame. So, let’s look at it from another perspective.

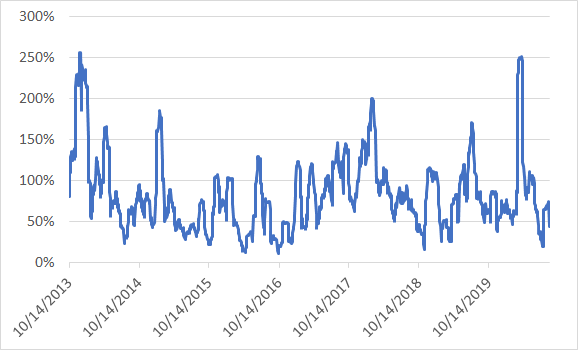

It could just be me, but I feel that the price movement of Bitcoin has calmed down recently. So, I decided to look at the volatility of price fluctuations for Bitcoin.

I’d say that the volatility is roughly 50% with a daily price movement of about 3%.

Looking at this, the volatility seems low recently. Things have calmed down since the 2017 bubble popped in 2018. It is even low compared to 2015 and 2016.

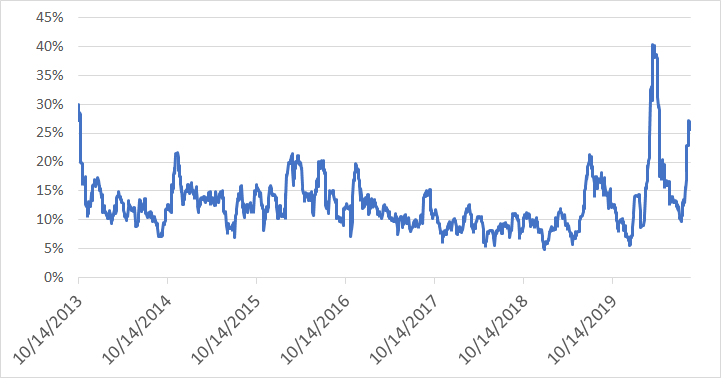

Now let’s look at the volatility of gold in figure 5.

There are some increases, but it is generally within 10 to 20%. The trends are not so different from past examples. Bitcoin and gold have different degrees of volatility, but it isn’t brought up in the conversation that much.

Looking at the results, one might assume that it is a coincidence that the two are considered similar since they have very little in common, and that Bitcoin is not as safe as a physical asset. However, the lack of correlation or connection to gold makes it a valuable asset.

This may sound like portfolio theory, but holding different, uncorrelated asset classes is more efficient for risk mitigation and returns. Bitcoin doesn’t move in a way that correlates with gold, but that just means that it makes sense to hold both Bitcoin and gold.

Although opinions on the security of Bitcoin as an asset vary, Bitcoin does have some merit as an investment and as part of a portfolio of assets due to the lack of correlations. This is a big deal, since portfolio managers are always looking for uncorrelated asset classes. Bitcoin fits in nicely. If Bitcoin were to move alongside gold, it would lose at least half of its value for portfolios.

In today’s post, we talked a lot about correlations. The data showed a lack of correlations, but I see that as a positive. I think that the lack of correlations actually work in Bitcoin’s favor.

Thank you for your time and insights Mr. Saito!

Data source: Kaiko

Disclaimer:

The information contained in this article is for general information purposes only. bitFlyer EUROPE S.A. does not assume any responsibility or provides no guarantee for the accuracy, relevance, timeliness or completeness of any information.

You accept that you are responsible for carrying out your own due diligence when investing. bitFlyer shall in no way be responsible for any acts taken on account of this article nor does bitFlyer provide any investment advice for its users.