It can be hard to keep track of all the market trends in the crypto world, and even harder to predict the future. To help decipher some of the biggest influences on the price of Bitcoin, bitFlyer Europe talked to Sho Koyama, a Japanese personal investor, who has been tracking crypto asset trends since 2013.

We wanted to hear his analysis of the market and predictions about the rest of 2020 and into 2021.

What has been the biggest influencing factor on the cryptocurrency market so far in 2020?

Sho Koyama: Based on the comprehensive data I track every day – including supply and demand, hashrates, the inflow of new money, and laws and regulations – undoubtedly the biggest influencing factor for Bitcoin is the global impact of Covid-19 on monetary relief and economic policies. This is due to the inflow of stimulus and temporary welfare payments into the crypto asset market.

Since the crypto asset market is new, the inflow of new money has a big impact. One way we have seen this having an impact in 2020 is through stimulus cheques and temporary welfare payments issued by governments around the world to help people who have been economically impacted by the pandemic.

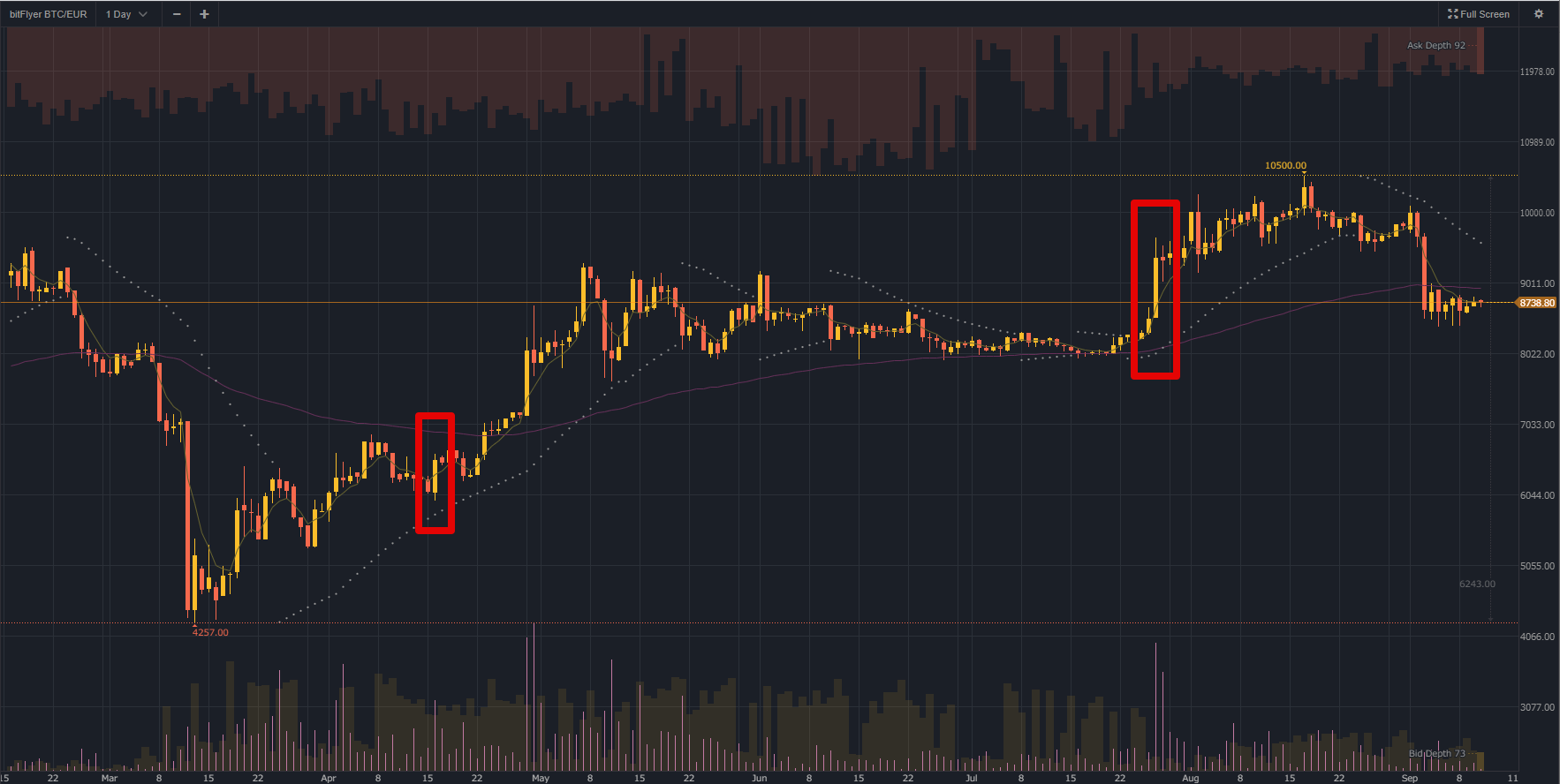

In April, the US Government issued stimulus cheques of $1,200 to millions of Americans. At the same time, there was a spike in deposits into crypto exchanges, including bitFlyer, of… you guessed it: $1,200.

While we don’t know for certain that thousands of Americans spent their stimulus cheques on crypto, Bitcoin prices increased by around 7% on 16th April from $6.6K to $7.1K. This increase in the Bitcoin price suggests a very strong correlation between issuing temporary welfare payments and buying Bitcoin.

This may happen again if governments propose new stimulus bills and distribute relief funds. The price moved considerably again on 27th July, the day after US Treasury Secretary Steve Mnuchin announced a new Covid-19 relief bill.

It seems clear then, that some of this economic support is flowing into investments such as stocks and crypto assets.

How else have the financial decisions of banks and governments influenced the market this year?

S.K: In response to Covid-19, governments and central banks have implemented large-scale fiscal mobilisation and monetary easing. To be specific, the Federal Reserve's monetary easing was tremendous, and the monetary base – which had been on a downward trend since 2018 – has rapidly increased. It has exceeded the historical maximum by more than 10%.

Gold also responded. The relative scarcity of the US dollar led to a price increase, which led gold to its highest price ever. The same goes for Bitcoin, which is sometimes called "digital gold". The halving in May was good timing for the change in supply and demand. Bitcoin is on the rise, just like gold.

However, it is important to note that the correlation is weak in markets where gold moves dramatically, so the price of gold cannot be taken as a clear indicator of Bitcoin price trends.

What about more technical factors? What part do they play on market trends?

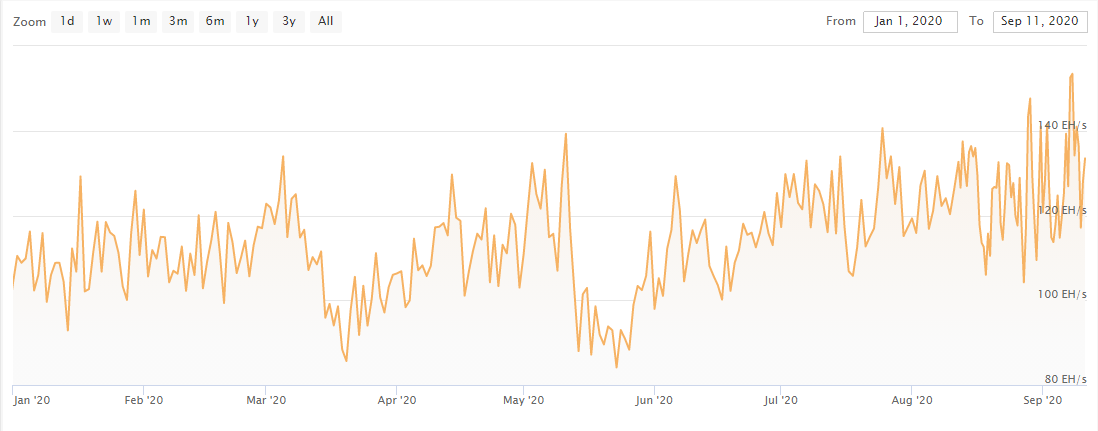

S.K: In the mid-term, we know that following hashrates and the number of active addresses has a strong correlation with the price of Bitcoin. The Bitcoin hashrate has continued to steadily increase. If the hashrate and the Bitcoin price correlate, we naturally expect the price to exceed €16K, but we have to consider difficulty adjustments and mining rig specifications, so there is more to consider that could have an effect on price.

Looking at the changes in the hashrate in 2020, we can see that the price has been rising moderately in correlation with the hashrates.

Based on this, Bitcoin’s hashrate and price does seem to have a degree of correlation, so hashrate is worth using as a reference.

Bitcoin mining costs are another way to anticipate changes in price. Just as the price of gold is affected by the price of mining it, the same can be said for mining Bitcoin. The mining cost recorded in July was about €7.3K, although in some regions, such as Kazakhstan and Iran, the cost seems to be lower.

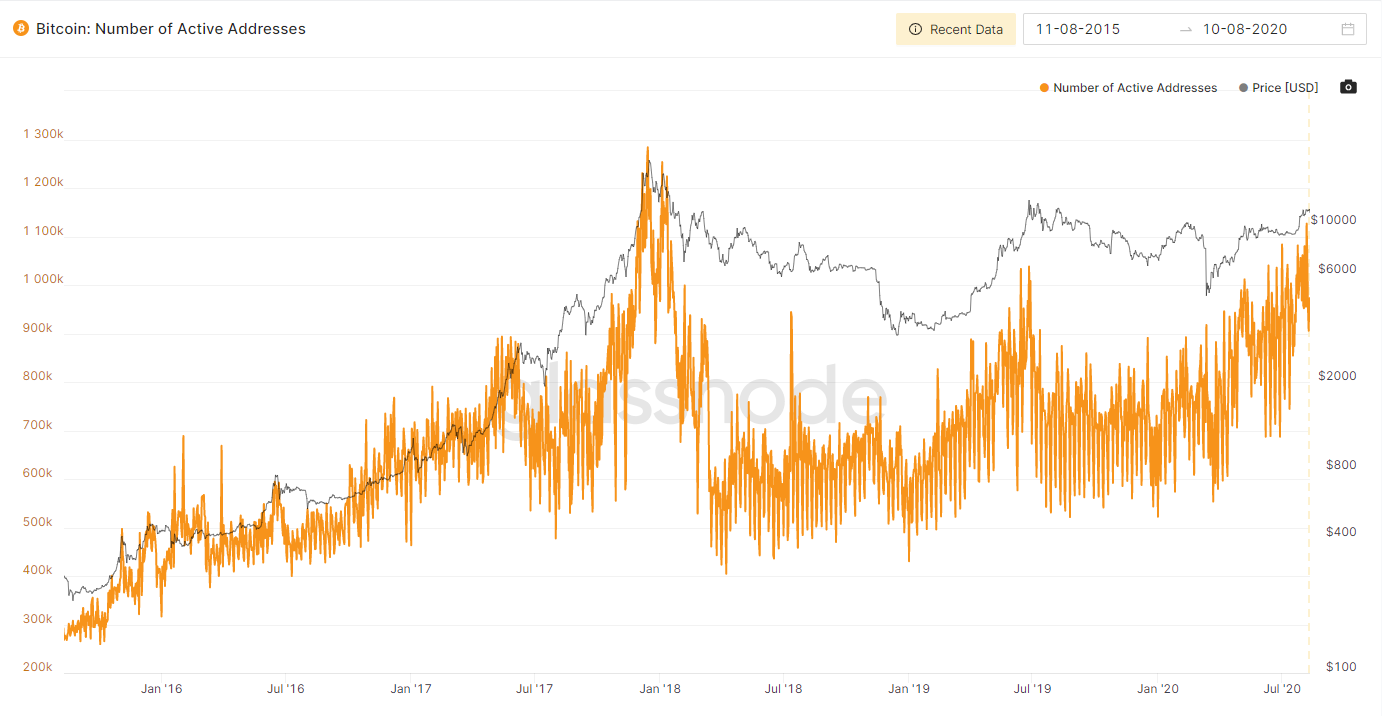

Another factor is trends in the number of active Bitcoin addresses.

We can see that it peaked in 2017 and then suddenly dropped off, but there was an upward trend in 2019. The thing to note here is that the lowest number of active addresses has been rising since the spring of 2020.

(At the time of writing) there were around 1.1 million active addresses, exceeding the previous highest number recorded in 2019. This suggests that the number of users may increase, and new money may continue to flow in, potentially leading Bitcoin to exceed the €12K mark.

Who are the biggest investors right now, and how are they impacting the market?

S.K: Grayscale, a major US crypto asset market fund, is known as ‘a whale’ (institutional investor with a large amount of assets under management) in the crypto asset market.

The fund's assets have risen dramatically, up by about 90% in the first half of 2020, doubling from $503.7 million in Q1 to almost $950.8 million in Q2. By the end of July, they held approximately €3.9 billion, or about 390,000 BTC.

With a fund of this size, their transactions can cause significant ripples in pricing. In June, they bought about 50,000 BTC, which is about twice the amount issued to miners. The price drop from €8.5K to €7.8K on June 11 or the €7.6K price on 15th June may have been related to purchases by Grayscale.

It would be difficult to buy and sell BTC worth €0.4 billion in a situation where trading prices were sluggish, like in June, unless such a sudden drop occurred. Even if it is an OTC trade, the BTC will eventually be bought somewhere, so it will naturally impact the market.

Looking at the price movement, it seems that the Grayscale funds flowed in around that time as the price rebounded the day after the sharp fall.

Grayscale is a well-known example, but there are other news reports that a huge amount of money is flowing in. For example, prominent hedge fund operator Paul Tudor Jones revealed that he is investing 1% of his assets in Bitcoin.

MicroStrategy, which provides business intelligence services, also buys Bitcoin as a means of hedging inflation. The strategy is to invest up to $250 million in alternative assets such as Bitcoin and gold over the next 12 months. We could well see other whale investors getting involved as the result of an improved investment environment for Bitcoin.

What other trends are you keeping a close eye on?

S.K: China used to be the biggest buyer of Bitcoin. This was primarily attributed to capital flight.

Chinese citizens are only allowed to buy up to $50,000 of foreign currency a year. Previously, investors got round these restrictions by a number of methods including real-estate, investments and invoice schemes, but in 2017 the Chinese government cracked down on these methods. However, the new regulations did not consider crypto to be ‘foreign’, leading to investors in droves purchasing Bitcoin.

The impact was that the trading volume and price of Bitcoin soared. Then when the Chinese government tightened up restrictions here, the price crashed again. Investors then responded by trading directly with overseas exchanges. According to a report by Chainalysis, more than $50billion worth of cryptocurrency moved from Chinese-based addresses to overseas addresses in 2019.

Bitcoin jumped to €10k in June 2019, but at the G7 Finance Meeting that was held a month later, it was considered mandating that customers must confirm their identity (KYC) before buying any crypto assets, which could impact people’s abilities to use overseas exchange sites. On June 25, however, the International Bureau of the Ministry of Finance announced that it would not go this far. Bitcoin rose by €1.2K the very next day.

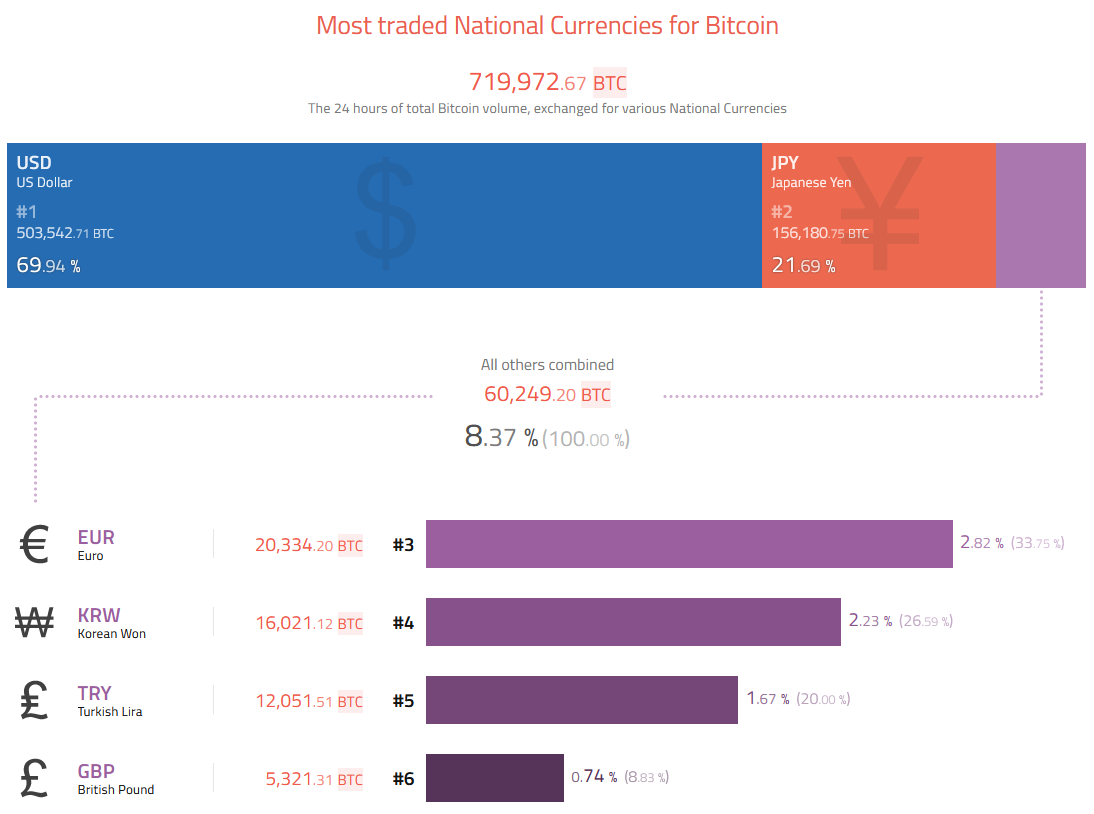

Cryptocurrency also serves as a store of value in developing countries. According to Coinhills, the Turkish lira is the number five fiat currency used for buying crypto assets.

There is no doubt that Bitcoin is being used as a means of overcoming the decline in the value of domestic currencies due to the Covid-19 shock.

I am also following trends in Russia. A law there on digital financial assets was passed in July. The use of crypto assets for payment of services and goods is prohibited, but trading is legal. However, the Deputy Governor of the Russian Central Bank has expressed opposition to crypto asset investment. The framework for the regulation of crypto assets will come after another digital currency related law is approved (planned to be passed in the State Duma by the end of the year). There is a possibility of Russian laws influencing the rise in the market.

This all sounds quite positive. What are the biggest risks over the next few months?

S.K: The biggest risk is that Bitcoin will take a downward turn after Covid-19. Inflation hedging and the relative scarcity of fiat currencies are major reasons behind people buying Bitcoin.

What happens if the vaccine development is successful? The market will run with the economy for the next six months. Funds are concentrated at a stretch on stocks such as travel, food, and transportation infrastructure that are not being bought at the moment. Bank stocks are expected to rebound, so the index will also rise. If that happens, the funds that were invested in gold and Bitcoin will be temporarily withdrawn, and it is possible that the price will plunge.

In 2020, the fiat currencies of developing economies have been suffering due to the effects of Covid-19. Thanks to Bitcoin, people may have a better way to protect their assets. It is odd, but Bitcoin does its best during hard times like the Cyprus bailout crisis of 2013 or during the Covid-19 pandemic, when fiat currencies and traditional assets are facing challenges.

I hope that the infrastructure of Bitcoin will be improved in the future, that the legislation advances, and that technology will be able to store value and make smarter payments and remittances.

For investors, it may be good for prices to keep rising. However, this has led to widespread fraud and stricter leverage restrictions. In Japan, the crypto assets that can be invested in are also very limited. Personally, I sincerely hope that the infrastructure and laws (including taxes) will be improved.

Sho Koyama (individual investor)

Sho Koyama has 12 years of history in investment. Since 2009, he has been trading in FX, stocks, CFDs, and other financial products. He started investing in crypto assets in 2015 and writing about it in 2017. From 2018 onward, he focused mainly on Bitcoin leveraged trading. His investment decisions are based mainly on the supply and demand balance such as investor trends and fundamentals analyses.

He has been a freelancer since 2018. He trades stocks in the morning and then works as a content marketer while keeping an eye on FX and crypto assets in the afternoon.

Disclaimer:

The information contained in this article is for general information purposes only. bitFlyer EUROPE S.A. is in no way affiliated with any of the companies mentioned herein. Neither does bitFlyer assume any responsibility nor provide any guarantee for the accuracy, relevance, timeliness or completeness of any information provided for by these external companies.

You accept that you are responsible for carrying out your own due diligence when investing. bitFlyer shall in no way be responsible for any acts taken on account of this article nor does bitFlyer provide any investment advice for its users.